Why Manufacturing Websites Fail to Convert Visitors Into Qualified Leads

Your manufacturing website looks professional, loads reasonably fast, and showcases your capabilities, yet the phone stays quiet and the RFQ inbox remains empty. Meanwhile, competitors with less impressive facilities generate a steady stream of qualified inquiries from their digital presence.

The disconnect between a good-looking website and actual lead generation is a fundamental misalignment between how manufacturing sites are built and how industrial buyers research and select suppliers. This article breaks down the specific conversion barriers that turn away qualified prospects, the technical and strategic gaps that undermine trust, and the proven fixes that transform underperforming websites into lead generation systems.

The Real Reason Most Manufacturing Sites Miss Lead Targets

Most manufacturing websites fail to generate leads because they lack a clear conversion strategy, offer a poor user experience, and overlook the fundamental elements of SEO and content marketing that encourage B2B buyers to take action. The typical manufacturing site treats its digital presence like an online catalog rather than a tool designed around how industrial buyers research and make purchasing decisions.

Here’s the thing, your prospects aren’t flipping through trade directories anymore. They’re doing deep research online, comparing capabilities, and vetting potential partners long before they fill out a contact form. Yet, most manufacturing websites still resemble digital brochures from 2005, expecting buyers to pick up the phone after seeing a product list.

The numbers tell the story. While manufacturing companies invest heavily in production capabilities and quality systems, their websites often get minimal attention beyond basic looks. This creates a gap between what buyers expect and what the website delivers.

Brochureware vs. Lead Machine: Spotting the Difference

Brochureware sites are static, product-focused digital catalogs that list what you make without guiding visitors toward real action. A lead machine is a conversion-optimized website designed to capture interest at multiple stages and turn that interest into actual inquiries.

The difference isn’t about adding more contact forms. It’s about recognizing that every page moves visitors closer to your sales team or pushes them toward a competitor who makes things easier.

1. Static Product Pages With No Next Step

Product pages that list specifications and tolerances without offering a clear path forward leave interested buyers stuck. An engineer confirms that you can handle their tolerance requirements, but then hits a dead end: no RFQ button, no consultation offer, and no sample request option.

2. Missing Value Proposition Above the Fold

Visitors form an impression within seconds, yet many manufacturing websites bury what makes them unique below generic factory photos. If a procurement manager can’t immediately grasp what sets your capabilities apart from three other fabricators, they’ll move on before scrolling.

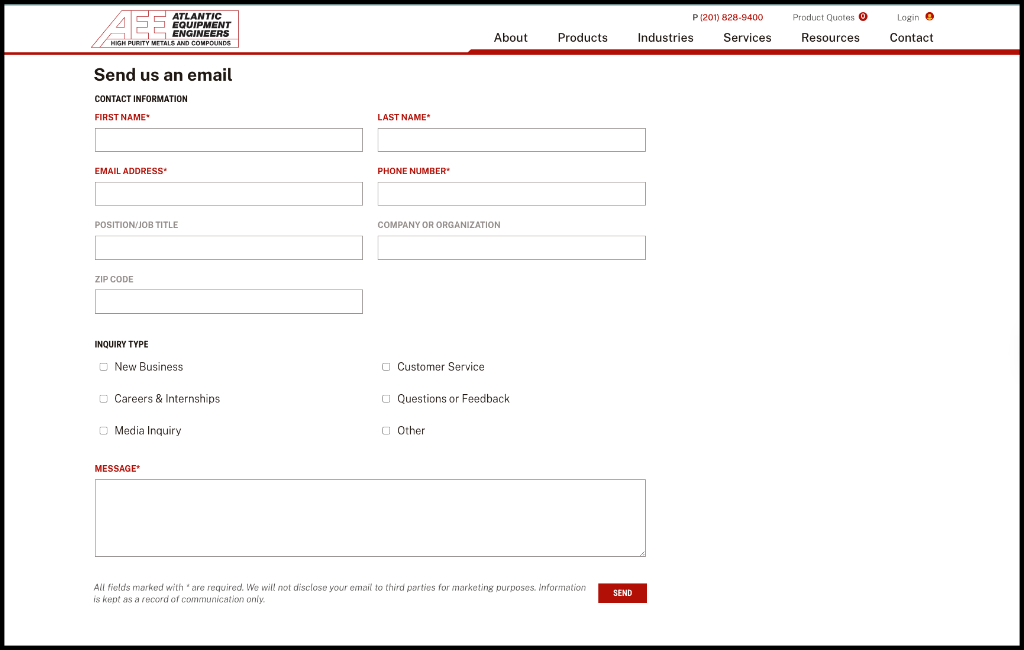

3. Generic Contact Us Footer Only

A basic contact form tucked in the footer treats every visitor equally, regardless of where they are in their buying process. Someone ready to request a quote has different needs than someone just starting to research suppliers, yet both get the same generic form.

Conversion Bottlenecks That Turn Buyers Away

User experience problems create friction that stops even interested visitors from becoming leads. These technical and design barriers are often invisible to the companies that own the websites, but noticeable to frustrated buyers trying to engage.

1. Confusing Navigation Labels

Industry jargon that makes sense internally often confuses external visitors. When your navigation uses terms like “Solutions” or “Capabilities” without clear subcategories, engineers waste time clicking around trying to find whether you handle their specific application.

2. Slow Page Load on Spec Sheets

Technical buyers expect instant access to documentation, but oversized PDFs and unoptimized pages that take 8-10 seconds to load test their patience. Every extra second increases the chance they’ll leave for a competitor whose resources load instantly.

3. Mobile Forms That Malfunction

Nearly 70% of B2B research now happens on mobile devices, yet many manufacturing websites have forms that break on smartphones. When a plant manager tries to submit an RFQ from their phone and the form won’t work, that’s a lost opportunity you’ll never get back.

Why Broad Keywords Starve You of Qualified Traffic

Targeting generic search terms like “manufacturing” or “industrial equipment” brings massive volumes of irrelevant traffic while missing the specific buyers looking for your capabilities. The goal isn’t just traffic, it’s qualified traffic from people with problems you can solve.

A custom machine shop ranking for “manufacturing services” attracts everyone from someone looking for t-shirt printing to a startup seeking injection molding. Meanwhile, the aerospace OEM searching for “precision 5-axis machining titanium components” never finds them because the site isn’t optimized for specific, high-intent terms.

Think about the difference in search intent:

- Generic manufacturing terms attract researchers, students, and job seekers with no buying intent

- Specific capability terms attract engineers and procurement professionals actively sourcing suppliers

- Problem-focused phrases connect with buyers who know their challenge but haven’t identified the solution yet

The companies generating consistent, qualified leads from organic search have moved past broad industry terms. They target the phrases their ideal customers type when they’re ready to engage a supplier.

Content Gaps That Undermine Engineering Trust

Technical buyers make decisions based on evidence of capability, and missing documentation creates doubt about whether you can deliver. While marketing teams focus on brand messaging, engineers look for technical proof points that build confidence in your ability to meet their requirements.

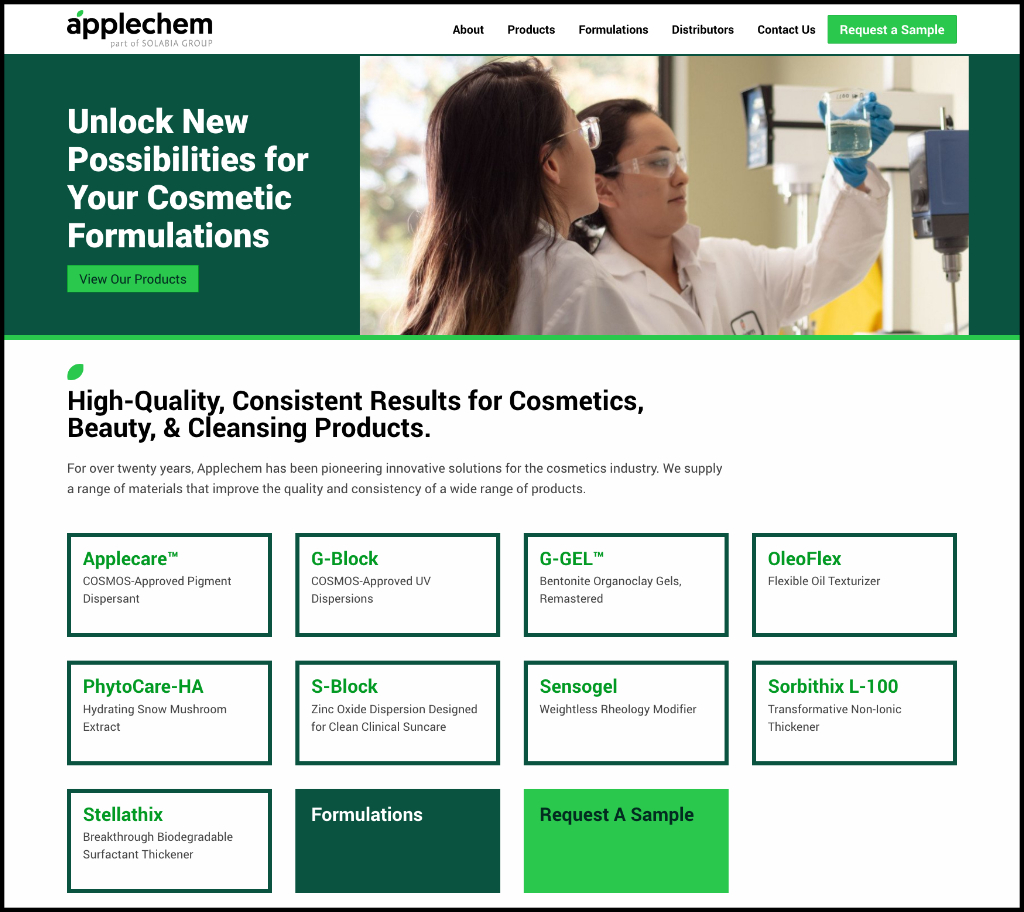

1. Absent Technical Datasheets

Engineers expect detailed specifications, tolerances, material certifications, and performance data before adding you to their approved supplier list. Vague statements like “precision machining” without supporting documentation about actual tolerances, equipment, or quality processes leave technical buyers with questions that prevent them from moving forward.

2. No Application-Specific Case Content

Generic case studies that simply list industries served don’t help buyers figure out if you understand their specific challenges. A medical device manufacturer doesn’t just want to know you work in medical; they want evidence you understand FDA requirements, cleanroom protocols, and biocompatible material selection for their exact component type.

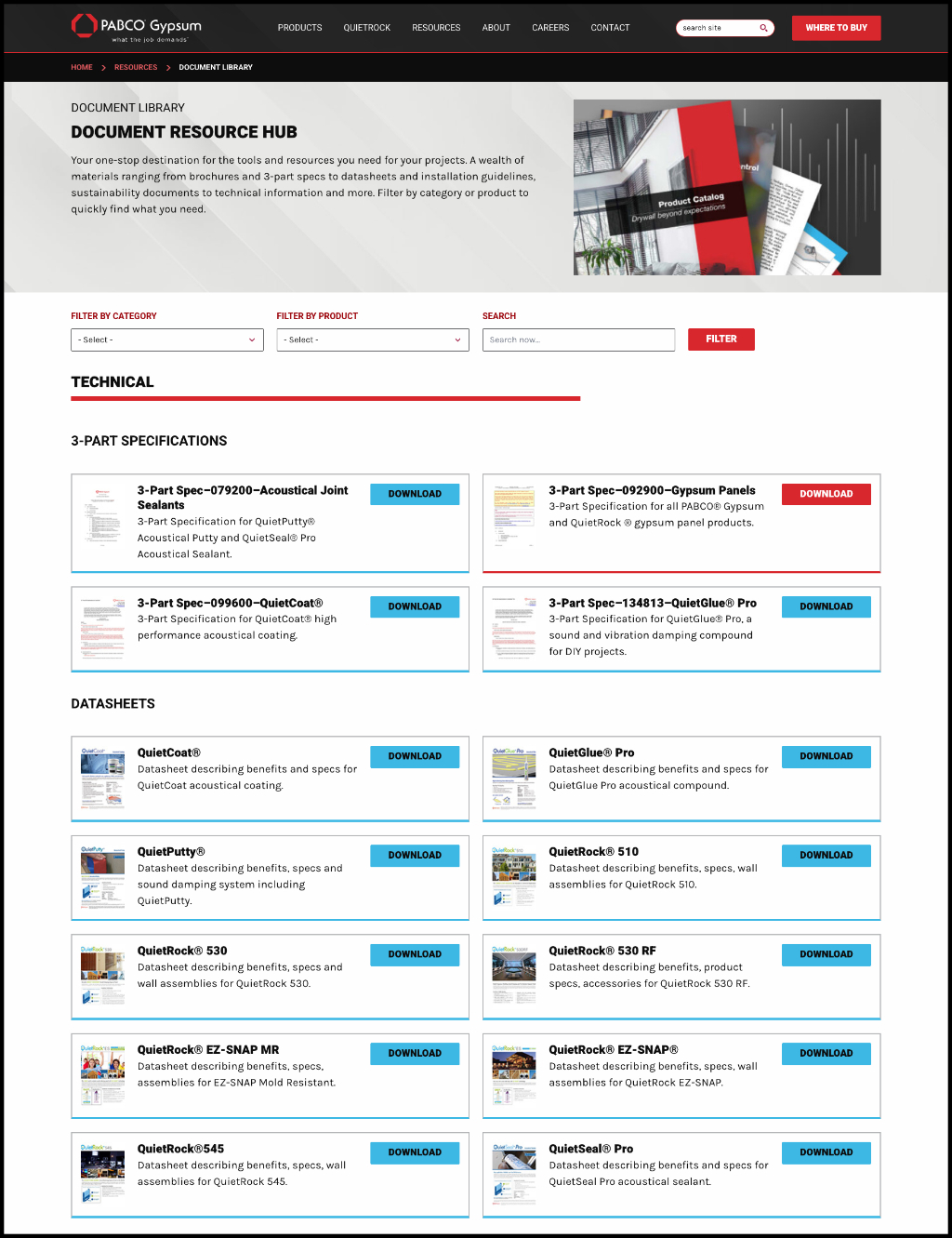

3. Lack of Certs, Standards, and Compliance Proof

Missing certifications and compliance documentation immediately disqualifies you from consideration for many projects. When ISO certifications, AS9100, ITAR registration, or industry-specific credentials aren’t displayed with current dates and scope, risk-averse buyers assume you don’t have them rather than digging deeper.

Technical Issues Killing Form Fills and RFQs

Behind-the-scenes technical problems prevent lead capture even when visitors are ready to engage. These invisible barriers are frustrating because the visitor wants to become a lead, but your website’s infrastructure stops them.

1. Broken CTAs or 404s

Dead links on call-to-action buttons or forms that redirect to error pages destroy trust at the moment when someone has decided to reach out. A broken “Request Quote” button doesn’t just lose that single lead; it damages your credibility and sends the buyer to a competitor whose website works.

2. CRM or MAP Not Connected

Form submissions that don’t flow into your CRM or marketing automation platform (MAP) create a black hole where leads disappear. A CRM is customer relationship management software that tracks interactions with prospects and customers. When sales teams don’t receive immediate notifications or leads aren’t entered into follow-up sequences, response times lag, and opportunities go cold.

3. Captcha Friction Reducing Submissions

Overly aggressive spam prevention that requires solving multiple CAPTCHA causes legitimate business inquiries to abandon the process. While some bot protection is necessary, forcing a busy engineer to identify crosswalks in twelve image grids often results in them closing the tab and moving to the next supplier.

Mapping Website Strategy to the Long Industrial Sales Cycle

Manufacturing sales cycles differ from those in other industries, often spanning 6-18 months from initial research to the issuance of a purchase order. Your website strategy accommodates this extended timeline by providing content tailored to each stage, rather than focusing on immediate conversion.

| Industry Type | Average Sales Cycle | Key Decision Factors |

| Software | 3-6 months | Features, integration, pricing |

| Manufacturing Equipment | 12-18 months | ROI, specifications, compliance |

| Custom Manufacturing | 6-12 months | Capabilities, quality, delivery |

| Industrial Components | 4-8 months | Reliability, supply chain, technical support |

A buyer researching potential suppliers in month one has different needs than someone preparing to request quotes in month eight. Early-stage visitors are looking for educational content on approaches, technologies, and key considerations. Late-stage visitors are interested in seeing detailed technical specifications, pricing guidance, and evidence of reliability.

Most manufacturing websites try to push every visitor toward immediate contact, which goes away early-stage researchers who aren’t ready for a sales conversation. Respecting where buyers are in their process and offering appropriate next steps for each stage increases conversion rates while building a pipeline of future opportunities.

Ready to transform your manufacturing website into a lead generation asset? Schedule a consultation to discuss how Lform Design develops conversion-focused websites for industrial companies.

Tracking KPIs That Prove Marketing ROI

Traditional website metrics like total visits or page views don’t tell whether your site generates business value. Manufacturing companies track performance indicators that connect digital activity to the sales pipeline and revenue. KPIs, or key performance indicators, are measurable values that show how effectively a company achieves business objectives.

1. Visitor-to-Lead Conversion Rate

This metric shows the percentage of website visitors who take meaningful action, such as requesting a quote, downloading technical documentation, or scheduling a consultation. A healthy conversion rate for manufacturing websites typically falls between 2-5%, though highly optimized sites in specialized niches can reach 6-8% for qualified traffic.

2. Marketing Qualified Leads by Source

Not all leads are equal, and knowing which traffic sources generate buyers versus tire-kickers helps you allocate resources effectively. Organic search traffic from specific technical terms typically converts at higher rates than paid ads targeting broad industry keywords, while referral traffic from industry directories often brings pre-qualified prospects.

3. Pipeline Value Attributed to Web

The ultimate measure of website performance is how much of the sales pipeline originates from digital channels. By tracking which opportunities started with website engagement and calculating their total value, you can demonstrate concrete ROI and justify continued investment in your digital presence. ROI, or return on investment, measures the profitability of an investment relative to its cost.

Step-by-Step Fixes to Turn Traffic Into Quotes

Transforming an underperforming manufacturing website into a lead generation system requires a methodical approach focused on removing barriers and creating clear conversion paths.

1. Audit Current Conversion Paths

Map out every route a visitor could take from landing on your site to becoming a lead, then walk through each path yourself. You’ll likely discover broken forms, unclear next steps, or missing calls-to-action that explain why qualified visitors leave without engaging.

2. Prioritize Quick-Win UX Changes

Start with high-impact improvements that don’t require complete redesigns, optimizing form fields, improving page load speed, fixing mobile responsiveness, and adding clear CTAs to high-traffic pages. UX, or user experience, refers to the overall impression a person has when interacting with a website or digital product. These changes often deliver immediate improvements in conversion rates while you plan larger initiatives.

3. Layer Targeted Content Offers

Create industry-specific resources like capability guides, material selection tools, or technical whitepapers that appeal to buyers at different stages. A procurement manager researching suppliers has different content needs than an engineer evaluating technical specifications, and offering both increases your chances of capturing leads throughout the buying cycle.

4. Automate Nurture Sequences

Set up email workflows that maintain engagement with early-stage leads who aren’t ready for immediate sales conversations. A series of educational emails that provide value over several months keeps your company top-of-mind. When the buyer is prepared to request quotes, you’re already a trusted resource rather than a cold prospect.

5. Review Metrics and Iterate

Establish a monthly review process to analyze what’s working and what isn’t, then make data-driven adjustments. Conversion optimization is an ongoing process; buyer behavior evolves, competition changes, and continuous improvement based on actual performance data separates lead-generating websites from digital brochures.

Transform Your Website Into a Lead Magnet Today

Manufacturing companies that treat their websites as strategic business assets rather than digital brochures see measurably better results in lead generation and pipeline development. The difference comes down to understanding how industrial buyers research and make decisions, then building digital experiences that support that process.

Your website either helps qualified buyers find you, trust you, and engage with you—or sends them to competitors who make those things easier. The technical capabilities that make your manufacturing operation excellent don’t automatically translate into a website that generates leads, which is why specialized web development that understands industrial buyer behavior significantly affects results.

Start a Project Today with Lform Design’s manufacturing-focused web development team to build a website that turns your digital presence into your most productive sales tool.

FAQs About Manufacturing Website Lead Conversion

What budget should manufacturers expect for a lead-focused site redesign?

Manufacturing website redesigns typically cost between $50,000 and $100,000, depending on complexity, custom functionality requirements, and integration needs with existing business systems, such as CRM and ERP platforms. ERP, or Enterprise Resource Planning, is software that manages core business processes, including inventory, accounting, and supply chain management.

How long does it take to see an increase in qualified leads after website optimization?

Most manufacturing companies see initial lead quality improvements within the first quarter, with significant increases in qualified lead volume typically occurring within six months of optimization as search rankings improve and conversion paths mature.

Which CRM and ERP integrations matter most for manufacturing websites?

Salesforce, HubSpot, and Microsoft Dynamics integrations are most critical for lead management and nurture automation, while ERP connections to SAP or NetSuite help streamline quote-to-order processes for companies with complex product configurations.

What constitutes a healthy visitor-to-lead conversion rate in industrial markets?

Manufacturing websites typically see conversion rates between 2-5% of total traffic, with highly optimized sites in specialized niches achieving rates up to 8% for qualified organic traffic from industry-specific and technical search terms.